Thrift Savings Plan

The Thrift Savings Plan (TSP) is a powerful retirement savings tool available to members of the military and federal government employees. Unfortunately it is one that is easily overlooked as it can seem intimating at first glance. In this article, we’ll delve into the various components of the TSP, covering everything from how to see your money, investment options, loans, and withdrawal specifics.

Eligibility: Who is Entitled to the Benefit?

The TSP is open to active-duty military members, reservists, members of the National Guard, and federal civilian employees. It offers a unique opportunity for eligible individuals to save for retirement through a tax-advantaged plan, ensuring financial security in the later stages of life.

In cases where individuals work full time federally and serve part time, two separate TSP accounts will be created. Both of which can managed in the TSP central portal (which I will be touching on next).

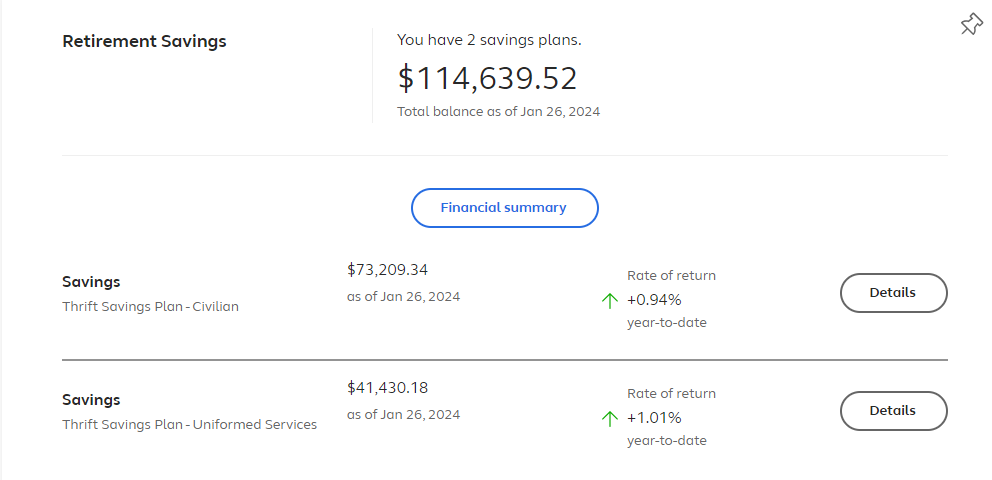

Viewing TSP Savings

To manage your TSP account and monitor your savings, you can access the official TSP website at:

An important thing to note is that each applicable user will already have an account created on their behalf as soon as they’re TSP eligible and contributing. All that is needed for members to access their savings is to register for their account through the websites login portal. Other than just viewing balances, members can see their contribution history, modify their investment options, and track their investment performances. It also offers valuable resources such as educational materials and calculators to assist in planning for retirement.

Investment Options: Tailoring Your Portfolio

TSP provides a range of investment options, allowing participants to tailor their portfolios based on risk tolerance, investment goals, and time horizon. The fund options include the:

- G Fund (Government Securities Investment Fund)

- F Fund (Fixed Income Index Investment Fund)

- C Fund (Common Stock Index Investment Fund)

- S Fund (Small Cap Stock Index Investment Fund)

- I Fund (International Stock Index Investment Fund).

Typically, members are automatically enrolled into the Life Cycle fund which essentially just does all the hard work for you of creating a diversified mix of the five individual funds mentioned. With early year initial investments being more aggressive and later years tailoring to a more conservative fund plan to lock in the savings in preparation for retirement.

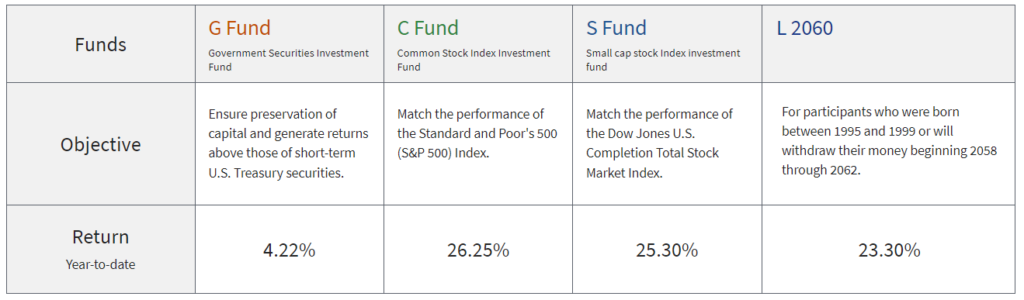

Now… I can not stress this enough but GO CHECK YOUR CURRENT FUND PORTFOLIO RIGHT NOW!! If you’re not currently tracking its status, it is extremely critical that you do immediately or risk missing out on significant financial gains. I will preface by saying that I am not a financial advisor but take a look at the image below:

It is not uncommon for service members to find out that they’re enrolled into some strange investment funds strategies. Would you rather be in the G fund or the C fund for 20+ years; which do you think would give you a bigger bang for your buck? Take control of your projected retirement.

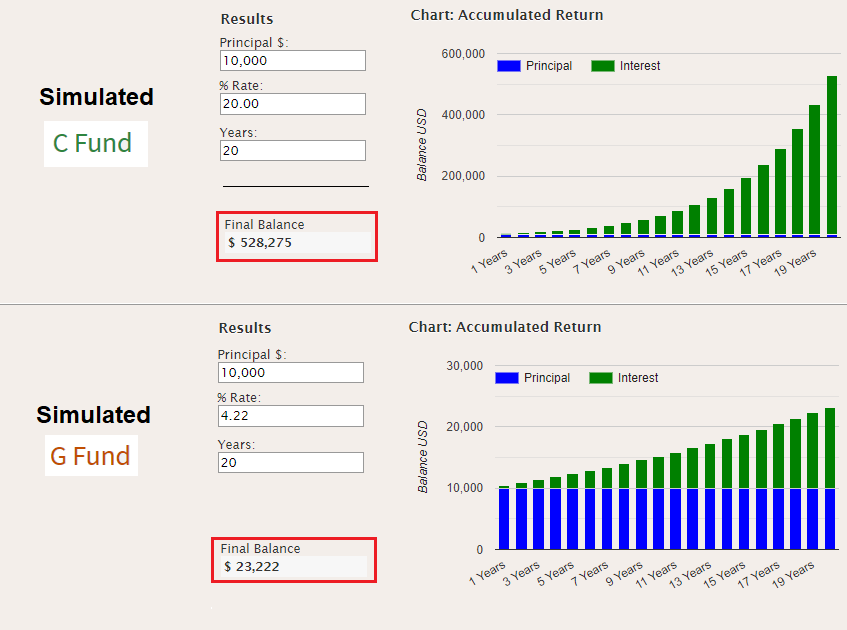

Compounding interest is extremely powerful and so to better highlight the differences take a look at these two charts:

The two charts represent a situation where:

- A member currently has $10,000 in their savings account

- They have 20 years until they reach the age where they can pull out their money

- Each simulated fund is reflected in the ‘% rate’

- No additional money is being contributed, its just a flat initial investment of 10k

Now, comes the reality of how much of an impact return rates can have on your money within the long run. Now imagine you continue investing money while its growing… we are talking a peace of mind level of savings.

BUT the figures shown represents a very very very black and white scenario that is not considerate of an individuals situation. Further more, never forget that percentage return rates are always changing! Even though at the time of this posting the C fund looks like a no brainer, it is also susceptible to a fluctuating return rate plummet, even lower than the G fund. Meanwhile the G fund has a history of more reliability and predictability that can be used to lock in any savings that have been accrued. That’s why there is so much more consideration that comes into place with how folks decide to invest their money.

If you plan on retiring within the next say two years, maybe you shouldn’t have all your money in the C fund. Last thing you want is for the day of your retirement to come and all your money has tanked. Thus comes the Life Cycle funds to the rescue that essentially does all the work of moving money based on the projected retirement age. There is absolutely nothing wrong with throwing it all in there (if its already not all in there).

I personally, as a non-financial advisor, invest in 80% C Fund and 20% S Fund with the intent to move all my money in the G fund when I am approaching retirement and want take less financial risk. Since I don’t plan on taking out money anytime soon, I can wait out any rate drops and within the long term I should still be projected to come out ahead.

Understanding each fund’s characteristics and aligning them with your financial objectives is crucial for optimizing your TSP investment strategy.

Loans: Tapping into TSP Funds

In times of financial need, TSP participants may consider taking a loan against their TSP account. The TSP offers both general purpose loans and residential loans, each subject to specific terms and conditions. While taking a loan can provide temporary relief, it’s essential to carefully consider the impact on your long-term retirement savings and the potential consequences if the loan is not repaid.

Withdrawal Specifics: Navigating the Retirement Process

Upon reaching retirement age, TSP participants can initiate withdrawals from their accounts. The TSP offers various withdrawal options, including partial withdrawals, full withdrawals, and annuities. Understanding the tax implications, withdrawal penalties, and distribution strategies is crucial for making informed decisions about the timing and structure of your withdrawals. Additionally, participants should be aware of required minimum distributions (RMDs) that apply once they reach a certain age.